40 common private equity interview questions. Examples include technical, transactional, behavioral, and logical tests with sample answers

Christy currently works as a senior associate for EdR Trust, a publicly traded multi-family REIT . Prior to joining EdR Trust, Christy works for CBRE in investment property sales. Before completing her MBA and breaking into finance, Christy founded and education startup in which she actively pursued for seven years and works as an internal auditor for the U.S. Department of State and CIA.

Christy has a Bachelor of Arts from the University of Maryland and a Master of Business Administrations from the University of London.

Reviewed By: Patrick Curtis

Prior to becoming our CEO & Founder at Wall Street Oasis, Patrick spent three years as a Private Equity Associate for Tailwind Capital in New York and two years as an Investment Banking Analyst at Rothschild.

Patrick has an MBA in Entrepreneurial Management from The Wharton School and a BA in Economics from Williams College.

Last Updated: May 28, 2024 In This ArticlePrivate Equity (PE) is often considered by professionals to be one of the most challenging sectors to break into within the finance industry. Vast amounts of talent from a variety of past professional experiences (investment banking, asset management, etc.) apply to private equity firms, seeing them as the golden exit opportunity due to generally better pay and (usually) better hours.

The competitive interview process is therefore designed to rigorously filter out potential candidates, with less than 1% of candidates receiving job offers.

Consequently, answering the technical, transactional, behavioral, and logical questions confidently and consistently is key to converting an interview into an offer.

The following free WSO PE interview guide is a comprehensive tool designed to cover every single aspect of the interview process, guiding you from the beginning to the end, therefore drastically improving your odds of landing your dream job.

This guide features a total of 40 of the most common technical, transactional, behavioral, and logical questions, along with proven sample answers that private equity professionals ask candidates during the hiring process.

We have also added dedicated sections on discussing previous deal experiences and featured a free LBO modeling test (video solution + modeling file) at the end of the guide to perfect your modeling skills! It is a great place to start your preparation before investing in our more comprehensive Private Equity Interview Course.

This resource includes 13 firm-specific questions from leading private equity firms (Blackstone Group, Kohlberg Kravis Roberts (KKR), etc.) and also proven sample answers to them.

This interview guide consists of 11 sections, each focused on different phases of the interview process.

There are no excuses for not perfecting what is in your control. Irrespective of the firm, the position, or your region, you can be sure these two questions will be asked as they're a standard in the industry.

Anticipating both of these questions beforehand, crafting a compelling narrative around them, and selling yourself on it will make you stand out from amongst the pool of potential candidates.

Dial-in a cohesive 90-second resume walkthrough that focuses on the positive and motivating reasons behind every shift (school to job, job to better job, most recent job to grad school).

There are two facets to answering this question immaculately. First, know your story and tell it like a master bard. When they ask you about yourself, they're judging whether they would want to work long hours with you. These questions hold serious weight; use them to make yourself a desirable coworker.

Second, have a few backup stories in mind. Stories that effectively portray you as a good teammate, a problem-solver, a go-getter. Have these stories ready and use them to answer whatever the interviewer asks you. Make sure your resume aligns with these. Tell them confidently and with clarity and relevance, and you'll be putting yourself in good territory.

Given the variety of professional backgrounds that candidates come from, WSO has created a dedicated page to answer this question. WSO's "Why Private Equity?" page covers 9 sample answers tailored for students and professionals looking to break into private equity.

The most comprehensive curriculum and support network to break into high finance.

Learn More

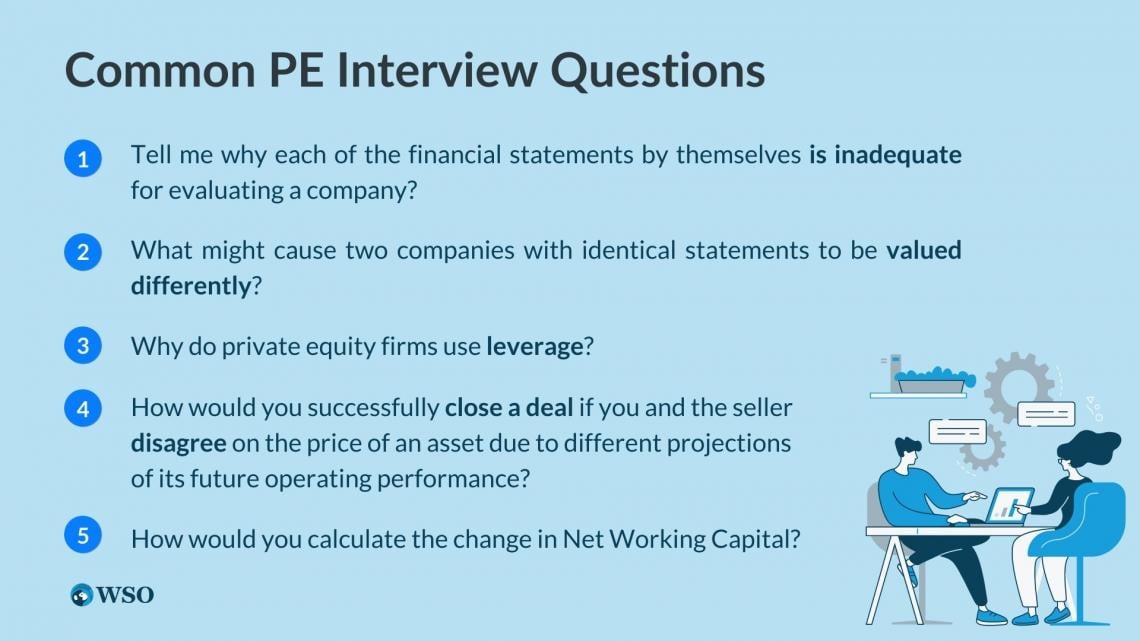

Technical questions are a critical component of almost every private equity recruiting process. Therefore, your interviewers will expect detailed and accurate responses to commonly asked technical questions, and your answers must demonstrate in-depth knowledge and expertise of the topic at hand.

The following section features 15 common PE interview questions, as determined by the WSO Company database and the Harvard Business School Venture Capital & Private Equity club members. A sample answer has been provided for every question.

At the end of these 15 questions, we also have provided you with eight exclusive firm-specific technical questions to kickstart your mock interview training.

The 15 technical questions covered below are exclusive to the private equity industry. However, PE interviews often overlap with investment banking interviews as general finance/accounting questions can also be asked. To check out an additional 30 technical questions with sample answers, check out WSO’s free 101 Investment Banking Interview Questions and Answers page.

Sample Answer:

Income Statement:

The income statement alone won't tell you whether a company generates enough cash to stay afloat or whether it is solvent. You need the balance sheet to tell you whether the company can meet its future liabilities, and you need the cash flow statement to ensure it is generating enough cash to fund its operations and growth.

Balance Sheet:

The balance sheet alone won't tell you whether the company is profitable because it is only a snapshot on a particular date. For example, a company with few liabilities and many valuable assets could actually be losing a lot of money every year.

Cash Flow Statement:

The cash flow statement won't tell you whether a company is solvent because it could have massive long-term liabilities which dwarf its cash-generating capabilities.

The cash flow statement won’t tell you whether the company’s ongoing operations are actually profitable because

cash flows in any given period could look strong or weak due to timing rather than the underlying strength of the

company’s business.

Sample Answer:

The financial statements do a decent job of painting a picture of a company's historical performance, but they do not essentially tell us all that we need to know about its future performance. Since the value of a company depends primarily on its expected future performance, the financial statements are insufficient.

Examples of important things financial statements don't tell us are:

Sample Answer:

PE returns are calculated based on the return on their invested equity. Using leverage to do deals allows you to use less equity which means the ultimate returns are larger in comparison to the amount of equity initially invested. Another way to look at it is that the cost of leverage (debt) is lower than the cost of equity because equity is generally priced to an IRR of 20%+, whereas the annual interest expense on debt is usually below 10%.

Yet another way to look at it is that using a lot of debt makes the return on equity much more volatile and much riskier because the debt must be repaid before the equity gets any return. The high returns on PE equity may be seen as the fair return associated with the extra risk associated with high leverage.

The most comprehensive curriculum and support network to break into high finance.

Learn MoreThis question can also be asked as “How does leverage increase PE returns?”

Sample Answer:

The classic PE solution to this common problem is called an "Earn-out." This solution is often used because sellers are more optimistic about the future performance of a business than PE investors are willing to underwrite. In such cases, either party may propose that the sellers are paid a portion of the total acquisition price up-front, while a portion is held back (frequently in an escrow account) until the business' actual future performance is determined.

If the business performs as the seller expects, the seller is paid the remainder of the purchase price, which may sometimes run to months or years after the deal's close. Conversely, if the business under-performs compared to the seller's expectations, then the buyer keeps some or all of the earn-out money. This type of structure is a common way of bridging valuation gaps between buyers and sellers.

Sample Answer:

The classic formula for NWC is current assets (excluding cash) less current liabilities. For a lot of businesses, it is sufficient to define NWC as:

NWC = Accounts Receivable + Inventory – Accounts Payable

Change in NWC is simply the difference between NWC in the current period less NWC during the previous period.

Sample Answer:

Debt capacity for an LBO is typically constrained by three primary ratios,

Any one of these ratios could be the governing constraint for a particular deal. For example, to estimate debt capacity for an LBO, you could take the lowest of the three under each of those ratios.

Total Leverage Ratio: The most common method for estimating this ratio is (Total Debt / LTM EBITDA). During normal times, Maximum Debt = ~5.0x(LTM EBITDA). During hot debt markets, this ratio can go up to ~6.0x, and during cold debt markets, it can fall to ~4.0x.

This ratio can also be higher or lower based on the nature of the target's business. Highly cyclical or risky businesses with few tangible assets are on the lower end of the range, while stable businesses with a lot of tangible assets (which can be liquidated to repay debt holders in the event of default) are on the higher end of the range.

Interest Coverage Ratio: The most common method for estimating this ratio is (LTM EBIT / Annual Interest Expense). The floor for this ratio is usually around 1.5x. Therefore, the maximum debt this ratio will allow is roughly calculated as:

Maximum debt = LTM*EBIT / 1.5 (Blended Interest Rate)

The blended interest rate depends on prevailing interest rates and how the overall LBO debt package is structured, but roughly 8-9% is a safe assumption.

Minimum Equity Ratio: Long gone are the days when PE firms could routinely buy targets for 5–10% Equity and 90–95% debt as a percentage of the total acquisition price. These days lenders demand that about 20–30% of the total acquisition price be equity. As such, you could estimate:

Maximum Debt = 0.75 * (Total Acquisition price)

Sample Answer:

The truth is that there have been many good deals done with targets that failed most of the criteria in the section. The key is price. Almost any target would make a good buyout candidate at a low enough price. Is there any company you wouldn't buy for a dollar? I caveat my answers to questions like these by asserting that "deals which check all the boxes are usually very expensive" and "all problems may be overcome with a price."

Sample Answer:

This is another common way to ask the same question about how attractive an industry is. The trick to this question is that it's not simply about identifying a good industry but rather about identifying an industry that is improving. If an industry is already high-growth and profitable, the valuations of acquisition targets are also likely sky-high.

Investing is about buying undervalued assets rather than simply good assets. For example, if you identify a bad/mediocre industry that is about to improve, you could probably find a lot of undervalued acquisition targets in it. Therefore, look for industries that are experiencing some of the following:

Sample Answer:

How much value PE firms actually add is an open question, but the following methods are frequently mentioned:

Sample Answer:

You always want to have one or two good pitches in your back pocket in case you get asked this question. Before selecting a candidate, refer back to the sections on the common attributes of LBO candidates and how PE firms make money. Try to find candidates that fit at least some of the following criteria:

Sample Answer:

TEV / EBIT

Price / Earnings (aka P/E Ratio)

TEV / Revenue

There are many other useful multiples, but the above should cover you in the vast majority of interview situations.

Sign Up to The Insider's Guide on How to Land the Most Prestigious Buyside Roles on Wall Street.

Learn MoreSample Answer:

Pros:

Cons:

Sample Answer:

Pros:

Cons:

Sample Answer:

Pros:

Cons:

Sample Answer:

Debt covenants are contractual agreements between lenders and borrowers (such as companies that have been bought via an LBO) that give lenders specific rights to help protect their investment.

Maintenance covenants:

Require the borrower to maintain a specific equity cushion or debt service coverage cushion to maintain their ability to repay its debt.

Incurrence covenants:

Prevent the borrower from taking specific actions which could be detrimental to existing lenders, such as taking on more debt or paying out cash dividends to equity holders.

Strict covenants can make the investment much riskier to a PE investor because a default on a covenant can result in the loss of the entire equity investment even if the portfolio company remains solvent.

Having a detailed understanding of the answers to the 15 technical questions above is going to give you a competitive edge over the applicant pool. However, to achieve full technical mastery, it is critical that you expect technical questions that are specific to different private equity firms.

The following section features eight exclusive questions asked that actual interviewers asked candidates at some of the world's biggest private equity firms.

The most comprehensive curriculum and support network to break into high finance.

Learn MoreThe following questions have been taken from WSO’s company database, which is sourced from the detailed experiences of more than 30,000 candidates with PE interviews. The WSO PE Interview Course includes access to over 2,447 questions across 203 private equity funds (no other resource comes close).

The Blackstone Group Technical Questions

Sample Answer:

Calculate the enterprise value (EV) by discounting the projected unlevered free cash flows and terminal value to net present value. Calculate the equity value by subtracting net debt from EV.

Sample Answer:

An average secondary fund can expect to perform with an IRR of around 13% and a MOIC of approximately 1.5x.

Sample Answer:

A SaaS company can be valued with multiples focusing on Sales and looking at User Growth.

Sample Answer:

Some metrics which are important to analyze are:

Sample Answer:

Factors that may cause different valuations are:

Sample Answer:

NOI / Cap rate = Purchase price

Sample Answer:

Sample drivers may include:

Sample Answer:

Revenue: Coffee/person, people/day, cost of coffee, any add-on pastries

Cost: Variable (cups, straws, water, coffee beans, etc.), fixed (rent, electricity), quasi-fixed (headcount)

The most comprehensive curriculum and support network to break into high finance.

Learn MoreThis was originally posted by @TheKing”. This post has been edited and formatted.

In the large majority of your interviews, you will get asked to walk through a case study. So what is a case study?

While it varies from firm to firm, here’s what it generally will look like.

Below, the OP reviews the factors that you should consider when completing your private equity case study in interviews.

Ensure that the company will be able to handle the additional debt brought on through an LBO while also providing for a strong return on investment through growth in revenue and profitability.

A company might have strong financials at first glance, but you’ll want to make sure they aren’t overly concentrated in one product area or with one customer. If there is any notable concentration, it had better be able to prove that it’s got sticky customer relationships, so to speak.

This ties in with profitability and customers/products. Does the target company have specific technology or processes that will enable them to continue to grow and maintain margins going forward, or are they susceptible to margin erosion as competition increases?

Is the company in a growing industry? How will it handle potential economic turmoil? How well is the target positioned in its industry? Is it a leader?

What's the management team like? Is it a founder-owned business? Has the team been together a long time? How built out is the team?

The strength of the management team is fundamental, and it plays a vital role in the middle market. Oftentimes, you'll look at companies with fragile management teams or owners looking to cash out and take a smaller role in the company going forward. These cases allow a PE firm to add value by placing solid professionals into management roles.

A company can be an absolute cash cow, but you'll need to be able to exit the investment at some point over a reasonable time frame (generally five years) in order to generate a suitable return on investment for your investors. So you'll want to have some ideas as to where eligible buyers might come from.

Now, reading a CIM will get you pretty far. You'll learn a great deal about the target company, its growth prospects, its industries, and its alleged upside potential. But, the CIM is a sales document. So, while you can glean a ton of helpful information from a careful read-through of a CIM, you'll also want to have something of a skeptical eye. Invariably, you'll have questions and concerns that you'd like to raise with management in the next round of the sell-side process.

Here are a few examples of questions you might ask.

This is a great time to develop specific questions based upon issues you uncovered in your read-through of the CIM.

This was originally posted by @Candor, a private equity associate. This post has been edited and formatted.

This video from our PE Interview Course highlights why and how you should be prepared to walk through your prior deal experience.

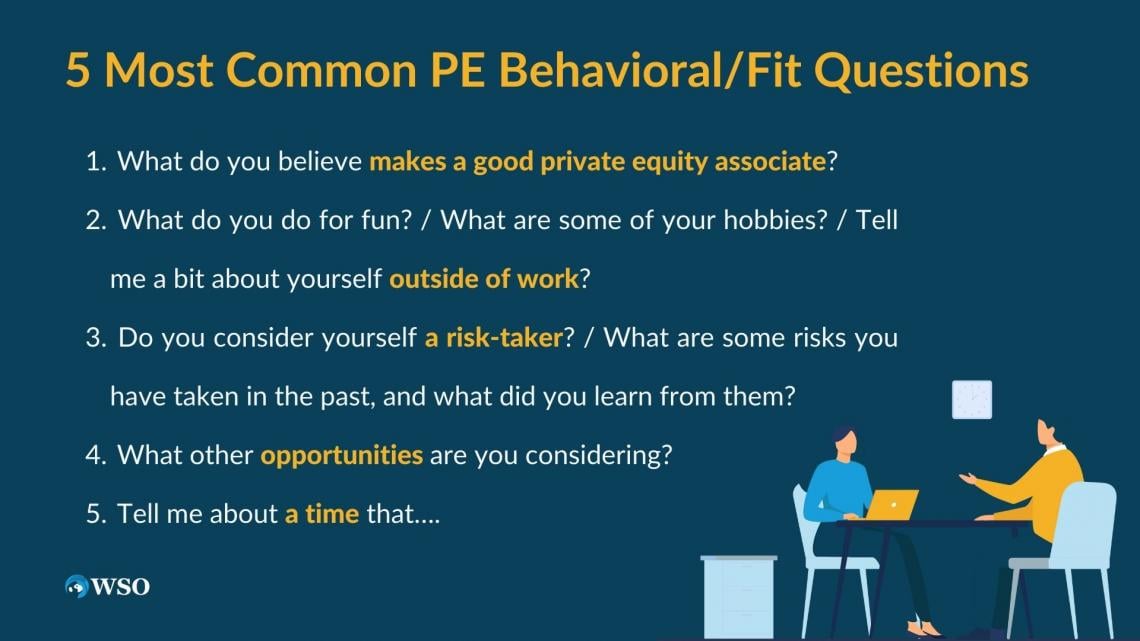

Fit or "behavioral" questions are used to assess whether you have the right attitude, work ethic, personality, and values to fit in with a PE firm's culture. Most PE firms take fit extremely seriously because most firms usually have only a handful of investment professionals who must collaborate over long hours and under tight deadlines.

This section walks you through 5 of the most common types of fit questions and suggests approaches for answering them. The suggested strategies and sample answers are meant to be illustrative. Always remember, you need to adapt your answers to be true to yourself and your own words.

The interviewer is trying to assess whether you really understand the job you are interviewing for. Your goal should be to answer the question and subtly make your case for why you would be good at it. It would be best to tailor your answer to each particular firm instead of giving one standard response.

For example, suppose a firm like TA or Summit requires a lot of proactive sourcing work from associates. In that case, you need to mention that and describe what makes someone good at sourcing (positive attitude, a lot of energy, curiosity, and gregariousness, ability to handle rejection, creativity, etc.). If a firm requires associates to engage with portfolio companies and help with operations deeply, you need to mention the requisite consulting toolkit.

Sample Answer:

The role of an associate can vary a lot from deal to deal, but I understand there are some common elements. For example, associates may be called on to develop investment themes, triage incoming deals, support deal diligence, and execution, and engage with portfolio companies at various points in the deal process. In addition, some common tasks that Associates are expected to perform are reading incoming CIMs, building LBO models, doing trading multiples analysis, competitive position analysis, and industry growth forecasting.

A question like this is a clear sign that the interviewer wants you to go off your resume and reveal a few of your interests and personality. The interviewer is trying to gauge whether they are a well-balanced person who would fit in with the firm on a personal level and be fun to be around for long stretches of time.

Put the CV away and talk about the things that make you fun and interesting. This is your opportunity to connect with your interviewer and demonstrate your likability in addition to your professional competence. So pick something interesting, and don't be afraid to get a little personal (this question practically begs you to get a little personal).

You probably want to avoid highly controversial topics, but you have more leeway here than most candidates realize. Sports, hobbies, talents, funny situations, unusual life stories, exciting achievements, outside passions, etc., are all fair game here. The most important advice is: be interesting. Be a real-life person that your interviewer will remember.

Your attitude toward risk is important in a PE context. PE firms look for people who take the responsibility of managing other people's money very seriously but who are willing to take prudent risks to generate returns. Your interviewer is looking for a willingness to take risks tempered by a careful and reasoned approach to balancing risks with rewards.

There are a couple of common ways to approach answering this type of question: You could tell a story where you took a well-calculated risk, and it paid off, or you could tell a story about a bad risk you took and how it taught you to be more careful. In either scenario, you want to affirm your belief that some risk is required for success but that you're the type of person who measures twice before cutting once.

This question is tricky because, as always, you want to be honest, but you don't want to necessarily reveal your entire hand or have to answer even more awkward questions like "what is your first choice if you had your pick." It is usually best to try and keep your answer to such questions vague in hopes that the interviewer will drop the subject, and frequently they do.

Suppose you are interviewing with some direct competitors and don't want to go into details. In that case, you can say something like, "I’m involved with some other processes, but I’m not under any time pressure, and I’m most excited about seeing where the process with [interviewing firm] leads first.”

In the rare case that your interviewer presses you to reveal names, try to reveal a couple that you suspect the firm will respect but won’t feel like they’ll definitely lose you if you get a competing offer. You can then try to give one or two credible reasons why you are most interested in the firm you are interviewing.

PE firms hate it when their offers get turned down, so you’re less likely to get an offer if the firm doesn’t think it has a great chance to sign you.

There are countless variations of this question, from “Tell me about a time you acted with integrity” to “Tell me about a time that you had difficulty dealing with coworkers.” It is key to have a well-rehearsed response for each of them and a general guideline to follow.

Ideally, you can develop 6-8 stories that cover the 30-40 basic questions, with slight modifications. DO NOT wing it. For every possible question, map out the story using the SOAR framework.

Address the Situation (10-15 seconds), Obstacle (10-15s), Action (60-75s), and Result (15-30s). Stories for these questions should span 1.5 to 2 minutes and focus on what’s important.

Knowing the culture of each private equity firm before walking into an interview is key to clicking with the interviewer and walking out with an offer.

The following section features five exclusive questions that interviewers ask in the world’s biggest private equity firms during interviews. This aims to help you jumpstart your training for the respective private equity firms you are interviewing for.

The following questions have been taken from WSO’s company database, which is sourced from detailed PE interviews experiences of more than 30,000 people.